An impact investment platform

Trine's mission is to promote clean energy and sustainable development to generate social and environmental impact while also generating financial returns for investors. It facilitates investment in solar energy in growing markets, helping thus address the need for capital and the financing gap in these markets.

Before investing in a solar project, Trine conducts a comprehensive assessment of the project's environmental, social, and governance risks to ensure that it aligns with their sustainability criteria. This due diligence process helps Trine to identify potential risks and opportunities, which can inform their investment decision-making.

Another example of Trine's sustainable finance practices is their investment offerings that align with the United Nations SDGs. Specifically, Trine focuses on investing in projects that support SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action). By investing in these projects, Trine helps to advance sustainable development goals and support positive social and environmental outcomes.

Finally, Trine reports on their impact and progress towards achieving their sustainability goals and SDG targets. This transparency helps to hold Trine accountable for their sustainability commitments and provides investors with the information they need to make informed investment decisions.

Trine has adopted sustainable finance practices that integrate ESG considerations into their investment and financial decision-making. These practices include:

Conducting thorough due diligence on potential solar energy projects to assess their environmental, social, and governance risks and ensure that they meet Trine's sustainability criteria. Offering investment opportunities that align with the United Nations Sustainable Development Goals (SDGs), specifically SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action).

They also report on their impact and progress towards achieving their sustainability goals and SDG targets.

Through these practices, Trine makes it possible for every investment to have a positive impact on people and the planet, as they help enabling solar companies to provide access to clean electricity.

Trine addresses pollution, climate change, and human rights.

In 2021, Trine offered for the first time the possibility of diversifying portfolios by choosing between six investment opportunities across different borrowers, sectors, and countries.

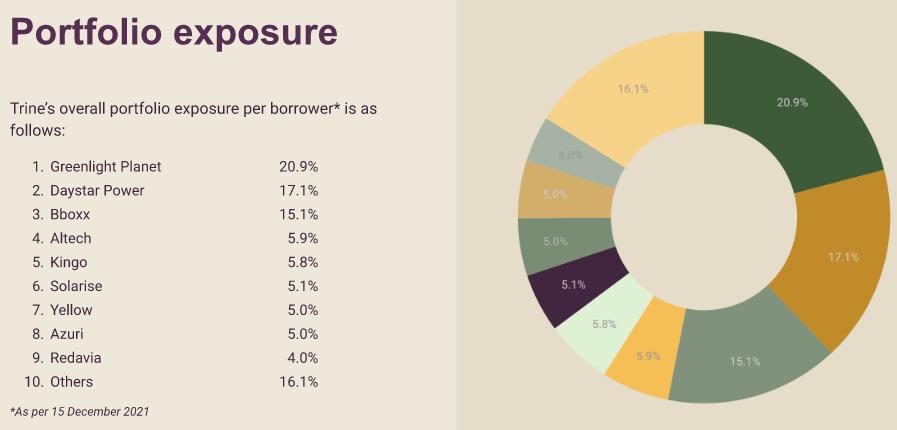

In the same year, they facilitated the investment of €17 million in solar energy, the issuing of 26 loans to 10 borrowers, and avoided 229 900 tons CO2. It also paid out €12.1 million to investors and had 82% of its portfolio deemed healthy.

In total by the end of 2021, €62 million was invested in solar energy, 529 900 tons of CO2 were avoided, and its partnership counts with 12 450 investors and 32 borrowers in 18 countries.

To date, the impact of the loans issued so far is predicted at 1 087 004 tons of CO2 avoided and 3 137 835 people with electricity. With 13 307 investors, the total amount invested in solar energy projects amounts to €83 012 376 while the total amount that was repaid (including capital and interest) amounts to €55 383 347 with a default rate of 4.2%.

Other achievements include: winner of inuse award in 2018, best social impact startup 2017, Sam Manaberi, CEO – Social entrepreneur of the year 2015, Climate Solver 2016, and Finance Innovation 2017.

To measure their performance and success, Trine uses indicators such as amount of CO2 that is avoided through the solar energy projects, the number of people that gain access to clean energy, the amount of funds that is evented and borrowed, the amount of funds that is repaid to investors, the default rate (a loan is classes as defaulted when the borrowers is unable to repay the loan and investors loose some or all of their investment), number of borrowers and loans, and number of countries where investment is facilitated.

Challenges related to this business model include the same associated to every financial advisor, such as the risk of financial losses, which require good reputation and trust from investors and borrowers. The company faced some challenges during the Covid-19 pandemic, as it led to a contraction of the market and thus contributed to limiting the amount of available loans for investment. As a result, they had a larger demand from investors than they could meet. To overcome this, they invested in diversifying their loan portfolio and in new payment solutions. They’ve made efforts to improve their ability to find and evaluate deals to grow their impact. Finally, when it comes to trust and reputation, investments were made to collaborate with AI identity identifications and with Trustly and Tink to enable secure and easy payments.

Trine, n.d.(1) Our Progress. Available at: https://trine.com/our-progress

Trine, 2021. 2021 Report, available at https://docs.google.com/presentation/d/e/2PACX-1vT0k2mLBV1zXhNwDZ0jy8lRdCfzxlLLb7oULLbzm8tQby-7KiMC7QDAMd_GJQhhkfVJpYUwdId7zg5c/pub?start=false&loop=false&delayms=3000&slide=id.p6

Trine, n.d.(2) Year end review 2021. Available at: https://trine.com/insights/year-end-review-2021

Trine, n.d.(3) How it works. Available at: https://trine.com/about/how-it-works

Trine, n.d.(4) Trine. Available at https://trine.com/

Español

Español Ελληνικά

Ελληνικά Polski

Polski Svenska

Svenska